2023 Year In Review

We hope 2024 is off to a great start for you and your loved ones! As we step into a new year full of possibilities, we wanted to provide an update on what has happened in the always evolving financial and economic landscape. While we don’t make predictions like the ones you see on TV, we do believe it is important for individuals to be informed and armed with clear and accurate information to make proper financial decisions.

After a very tough investing year in 2022, which saw both stock and bond indices face double digit percentage declines, 2023 was a much more prosperous year for investors with positive returns from both stock and bond indices—particularly in the fourth quarter. In addition, 2023 also experienced a much more modest inflation environment than was endured during 2021 & 2022—a big “win” for everyone.

Stock Market Performance

Most of the Wall Street forecasts for 2023 were quite pessimistic heading into last year. The Federal Reserve continued its fight against high inflation by further raising interest rates, potentially slowing economic growth as lending is curtailed and more costly. Despite the “consensus” that financial markets would struggle again, 2023 was marked by a positive year across global equity markets. For the calendar year 2023, major stock indices, such as the S&P 500 and Dow Jones Industrial Average, posted positive total returns (price appreciation + dividend income) of 26% and 15% respectively. The MSCI World, a global stock index benchmark, returned a strong 23% in 2023. Remember, a year earlier in 2022 both the S&P 500 and MSCI World index declined more than 18%. Red Bucket assets!

The U.S. technology sector as represented by the Nasdaq index, which experienced a loss of 33% in 2022 versus the 18% loss for the S&P 500, saw a complete reversal of fortunes in 2023. This Nasdaq index, which has top holdings of household U.S. technology names like Apple, Microsoft, Amazon, Meta, Tesla, and Nvidia, experienced an extremely strong rally of 43% in 2023. In comparison, “legacy blue-chip” dividend stocks as represented by the Dow Jones Dividend 100 index comprised of such companies as Home Depot, Verizon, and UPS experienced a much more modest total return of only 4.5%. Important to note, this dividend index only declined roughly 3% in 2022 and was much more protective in that downturn. Yellow Bucket assets! As they normally do, financial markets experienced surprises in 2023, something we expect to happen at Mirus Planning and very difficult to consistently predict!

2 Year Lookback of Major Stock Indices Total Return (1/1/2022-12/31/2023)

Purple line: S&P 500 Index ETF | Blue line: Nasdaq Index ETF | Orange line: Blue-Chip Dividend Index ETF

Interest Rate Movements & Fixed Income Returns

Interest rates in 2023 were again a key focal point for consumers, investors, and policymakers alike. The Federal Reserve continued a tough balancing act of combating high inflation while not pushing the economy into a recession by pushing interest rates too high. After an extremely aggressive approach by the Federal Reserve in 2022, which saw the Federal Funds benchmark rate rise from 0.25% to 4.25%, we saw a much more modest view in 2023 with 4 additional rate hikes of 0.25% each. This brought the Fed Funds target benchmark rate to 5.25%-5.50% to close out 2023.

These interest rate adjustments have had a direct impact on various asset classes. Fixed-income securities, which experienced a very tough 2022, were on much better footing in 2023 thanks to a higher interest rate environment and the higher income yields these investments provide as a result. The Bloomberg U.S. Aggregate bond index, an index comprised of both U.S. investment grade corporate bonds and U.S gov’t treasury bonds; experienced a total return of 5.5% (Total return = Price appreciation + interest income). An investment in the Fidelity Bond index which tracks this U.S. Aggregate bond index, provided price appreciation of 2.3%, while also generating 3.2% in interest income to achieve that total return of 5.5%.

In 2023 we also saw CDs and money market accounts yielding over 5% for the first time in over a decade, as these investment vehicles closely track the interest rate set by the Federal Reserve. If the Federal Reserve does indeed lower interest rates in 2024 (as currently forecasted), we will subsequently see lower interest rates from these CD and money market investments. We have and continue to be a big proponent of putting excess cash to work in these cash management vehicles, as most traditional checking and savings accounts are not passing on these higher yields to consumers. The window to lock in these higher rates will likely be closing sooner than later, so please reach out to us if you have questions about the best places for your extra cash and we are happy to provide guidance!

As appealing as 5% CD rates on cash are, what else should an investor be considering in this environment? Historically these high interest rates on cash have marked a great time to own traditional stock and fixed income portfolios for the long-term as this research piece from JPMorgan Asset Management shows.

Source: JPMorgan Asset Management, Guide to The Markets Q4 2023

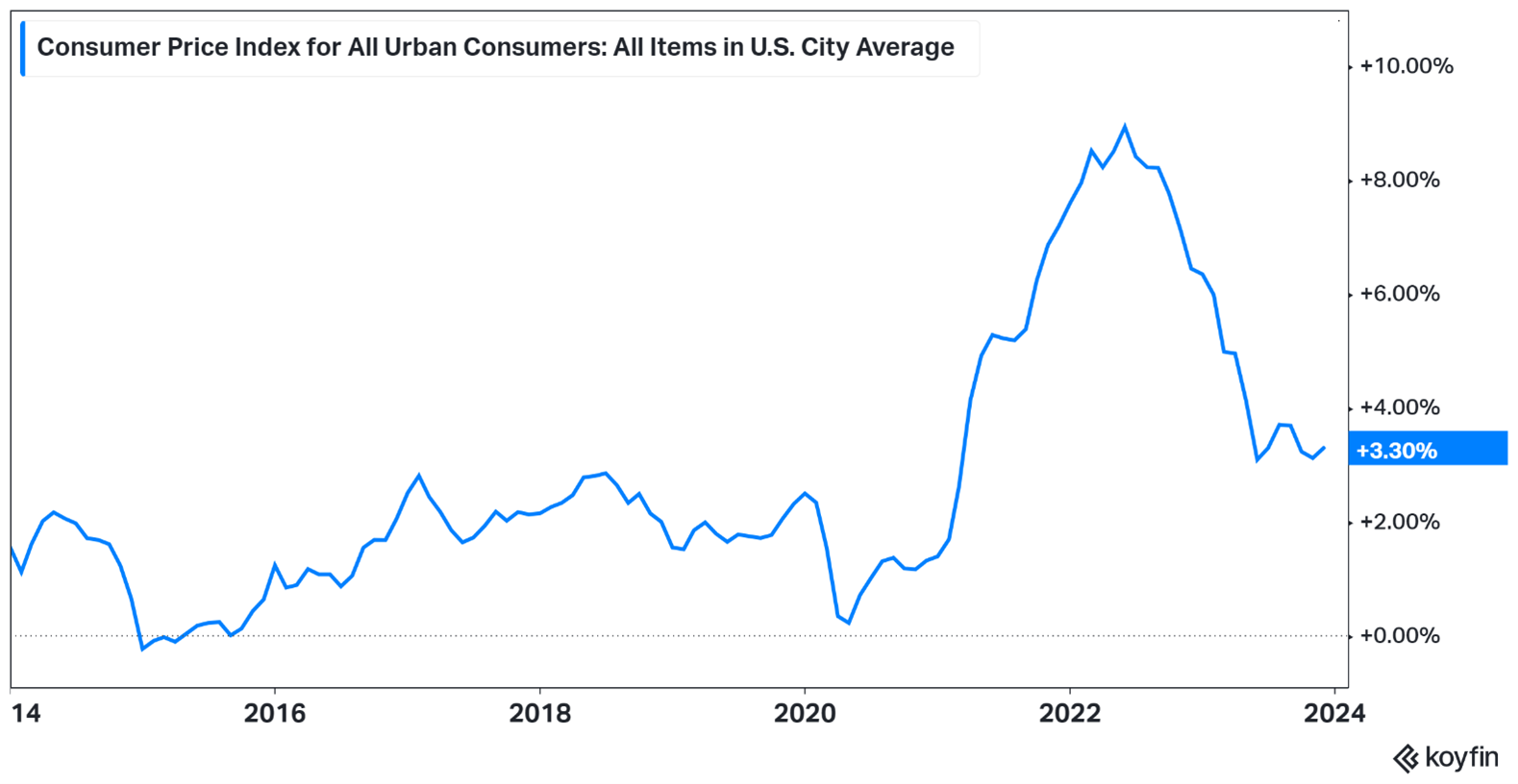

Inflation Update

Inflation has been a key concern for consumers and investors since early 2021. After the abnormally high price levels experienced in the post-pandemic recovery phase, inflation began to moderate in 2023. While inflation currently remains a bit higher than the FED’s 2% target, it is important to note inflation can be influenced by geopolitical events outside of the Federal Reserve influence. While much progress has been made to combat high inflation, we cannot declare that the higher inflation than desired is completely cured.

Financial Planning Note: Social Security provides recipients with an annual cost-of-living-adjustment (COLA) that is derived from inflation data very similar to the chart shown above. In 2024, the Social Security COLA will be 3.2%. In 2023 by contrast, the COLA was 8.7%, the highest benefit increase since 1981. In 2016 the COLA adjustment was 0%, and a very low 0.3% increase followed in 2017. This goes to show the volatile nature of inflation during the past decade.

Election Year 2024

As we approach another election year, it's important to remember the bipartisan nature of economic prosperity. Historically, the financial markets have demonstrated resilience and growth under various political leadership, showing that our economy can thrive regardless of which party is in power. As you can see in the research from the JPMorgan chart below, political affiliations do have a strong impact on how one ultimately feels about the economy. When your party is in control, it turns out Americans from that party feel better economic conditions (see 2017-2021) versus (2022-current).

Looking Ahead to 2024

As we move into a new year, our 2024 prediction remains the same as it was last year and in years before: Expect the unexpected! It is essential to have a plan for all potential economic situations and outcomes, and to remain vigilant and adaptive as our world constantly evolves. In 2023, it is safe to say we were surprised to the upside! A welcome surprise by all.

To hear more about these topics in further depth and many more relevant topics, we are extremely excited and honored to host Phil Blancato, Chief Market Strategist at Osaic, to speak to our clients in an exclusive webinar on February 13th at 9 AM PST (click here to register).

At Mirus Planning, we are committed as ever to guiding you through these complex and changing times with personalized financial guidance unique to your personal circumstances. We thank you for your continued trust and partnership with our team and look forward to connecting with you in 2024!

If you have any questions or comments about items in this letter, don’t hesitate to reach out to us at team@mirusplanning.com

Best regards,

Kyle Temple

CFP®, CPWA®